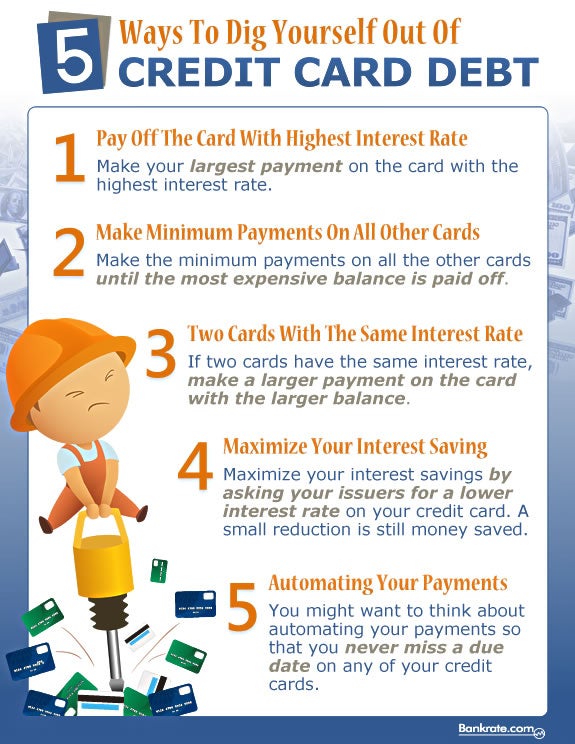

1. Dig Yourself Out of Debt

Looking for ways to get out of credit card debt? This infographic shows you 5 ways to help put an end to your credit woes. Start by figuring out which cards have the highest interest rates and make it a priority to pay these off first. Also look into automating your payments to make sure you’ll never miss a due date. By keeping up with your minimum payments and asking for a lower interest rate, you’ll help dig yourself out of debt.

2. A Look at the Lifecycle of Credit and Debt

Have you ever wondered how debt and credit scores can vary with age? This infographic shows the lifecycle of debt and how a credit score can change over time. Because younger borrowers typically have fewer lines of credit, they have a shorter credit history and therefore have fewer factors that can determine their credit worthiness. However, as a person grows older, their credit history lengthens, which means their credit scores typically increase as well.

3. How a Lack of Savings Can Cause Financial Stress

According to a recent survey from LearnVest and Chase Blueprint, saving for retirement was found to be the number one money issue people had. Unsurprisingly, a lack of savings and hefty credit card debt were found to be the second and third biggest worry. Health care costs were tied with day-to-day expenses for fourth, with housing costs not far behind. The reason people were found to stress the most over retirement was because they were unsure if—and when—they would be able to. This infographic highlights the importance of money management and how crucial it is to start saving early.

Do you have a sound plan for retirement? One thing we’ve learned from these infographics is that there’s no better time than now to start managing our debt. Use these helpful tips to secure a strong financial future for you and your family.